Do you have any problem in GST in Derabassi & Zirakpur.

Are you facing issue in Account Invoicing ?

Income From Salary (U/S 17)Salary is the remuneration paid by the employer to the employee for the services rendered by him for a certain period of time. It is paid in fixed intervals i.e. monthly one-twelfth of the annual salary. Salary includes:Basic Salary or the fixed component of salary as per the terms of employment.Fees, Commission and Bonus that the employee gets from the employer for of his services.Cash, Servant Allowances that the employer pays the employee to meet his personal expenses. Allowances are taxed either fully, partially or are exempt.Allowances which are fully taxable D.A. (Dearness Allowance) part of salary is fully taxable in the hand of employee overtime or extra duty payment made by the employer to employee for his service.City Compensatory Allowance, given by the employer to his employee for meet the personal expenses. Deputation allowance.Partially taxable Allowances Partially taxable allowances are those allowance which are exempted to certain limit, in other words we can say these type of allowances are taxable after certain limit.Type of these allowances are given below:-House rent allowance (Exempt as per limit define in Sec. 10)Special Allowance (Including Children education allowance, Children Hostel allowance)Fixed Medical Allowance.Conveyance Allowance (Exempt as per limit Define in Sec 10(14) ).Entertainment Allowance.Perquisites given by employer are also taxable .Perquisites are defined in section 17(2) of the Indian income tax act of 1961. Perquisites as any casual emolument or benefit attached to an office or position in addition to salary or wages.In other words we can say Perquisites are benefits provided by the employer in addition to the normal salary at a free of cost or concession rates.Main difference between allowances and perquisites is that allowances are part of Salary and perquisites are benefits given by employer other than salary due to position.1. CALCULATION OF EXEMPTED HRA AMOUNTThe tax free amount of HRA is minimum following:-a) Actually HRA Received from employer.b) 50 Percent of the salary if the accommodation is in the metro cities(Delhi, Mumbai, Chennai, Kolkata), or 40 Percent of the salary for other cities.c) Excess rent paid over the 10% of the annual SalarySalary (for Above calculation) - Basic Salary+ DA and Commission if received on basis of commission.Transport allowance is exempt to 1600/- PM(under current provision.Do you need GST number ?

Have You faced any problem with Goods and Services TAX Offline Tools during installation ?

For all type of Accounts problem solutions Call Us Mohinder : 9736155228 in Panchkula

Door step solutions in Panchkula in very nominal charges.

Goods and service Tax (GST) replaced Sale tax, Service Tax, Entry Tax, Excise and many indirect taxes and implemented from 01 July 2017. Government of India gives some relaxation to small Dealer and manufacturer in GST.

Dealers / Manufacturer having turnover up to 20 Lakh in a year not required o register under GST.

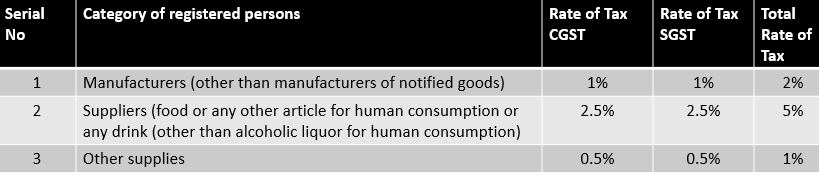

Dealers / Manufacturer having turnover up to 75 Lakh can register under composite scheme, this scheme only for the Dealers/Manufacturer whom are dealing in goods, but hotel that are giving room on rent and rent is up to 2500 also got benefit under this scheme. A dealer register under composite scheme cannot make interstate dealing. A dealer cannot charged or collect GST from his customer he has to pay the GST from his pocket. GST Rates under composite scheme as under:-

A new concept RCM (Reverse Charges Mechanism) is introduced under GST. However it is not new concept for service providers, because RCM is already applicable of certain type of services in Service tax. But Dealers/Manufacturer whom are dealing in goods, it is a new concept. It is first time when goods are also covered under RCM. In this concept every purchase from unregister dealer covered under RCM.

Government gives relaxation for small purchases up to rs 5000/- . In other words we can say dealer have not required to pay GST under RCM up to Rs 5000/-.

Registration limit of rs 2000000/- and 7500000/- is not applicable to Reverse charges, hence we can say every dealer who is liable to pay RCM required to register under GST. No threshold hold limit applicable for the same.

| Return Form | What to file? | By When? |

| GSTR-1 | Details of outward supplies of taxable goods and/or services effected | 10th of the next month |

| GSTR-2 | Details of inward supplies of taxable goods and/or services effected claiming input tax credit. | 15th of the next month |

| GSTR-3 | Monthly return on the basis of finalization of details of outward supplies and inward supplies along with the payment of amount of tax. | 20th of the next month |

| GSTR-9 | Annual Return | 31st December of next financial year |

CGST, SGST and IGST are main components under GST regime. When any business raise a invoice(register under normal scheme) have to charge IGST or CGST and SGST.When a dealer make interstate sale the he has to charge IGST in his invoice and at the time of making intra state sale has to charged CGST and SGST rate of CGST and SGST is depend on GST rates.

For example if GST rate is 18% then as dealer rising invoice for interstate sale he has to charged IGST @ 18% and at the time of intrastate sale then he charged CGST 95 and SGST 9%. In case of dealer location is in union territory the he has to mention UTGST in place of SGST.

Under the old tax regime, the sale of packaged software attracts both VAT and Service tax. VAT rate is around 5% in most states and service tax rate is 15%. Excise duty is also applicable in the case of manufacturing of IT products.

Example: If a software comes on a DVD, CD or hard disk, then there are 3 taxes that apply to it.

All such complications and double taxation will be removed under GST.

GST on IT sector will attract 18% on software services provided by software companies. For purely software services, the cost of such services will increase under GST.

GST rates for exports services are zero-rated and input taxes paid will be allowed as a refund. The default rule for place of supply (export of service) is the location of the service recipient if the address of the recipient is available. So, exporters must ensure that the address of service recipient can be presented before the authorities on request.

GST rate for services has increased to 18%, IT industry will definitely benefit from GST.

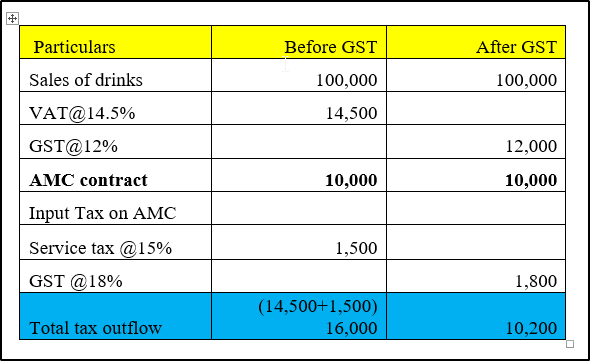

Example : - Mohit sale for the month worth Rs. 1,00,000. He also has to pay an AMC of Rs. 10,000 per month on the computers used in his offices.

The role of C & F agents was inter link between manufacturer and consumer. The appointment of C & F agents was basically with two purpose :

After introduction of GST, CST factor is gone away and companies appointed C & F agents for this factor alone are certainly effected.

But most of big industrial houses appoint C & F agents with economy and growth in mind and it will not effect the business of such trade houses.

C & f agents have to take separate GST no. for their each different state Warehouse . In this case every, state warehouse have required different GSTN and to submit different GST return. It increases the burden of compliances on C & Fs. Benefit of this is no. of warehouse decline due to GST imposed and fixed rental cost also reduced. Tax rate of all state will be same and Stock transfer will also taxable after implementation of GST.

income under this section chargeable to tax if following conditions are satisfied:-

Rental income of vacant plot (not appurtenant to building) is not chargeable under this act but taxable under the head PGBP of IOS as case may be.

For Example:- Land given to any office in rent for parking (owner of office is other person and land has not any construction) is chargeable to tax under IOS & PGBP as case may be.

Income is taxable under this section only in the hand of owner, owner can be a legal owner or deemed owner. Definition of deemed owner given in section 27.

If owner of house property used his property in his business as a Factory, Warehouse, Parking area and for any other purpose can not be taxable under this head.

Exemptions

Farm house is not chargeable under this act, in other word we can say income from farm house is not taxable or exempt.

Owner ship of house property lying with Municipality.

House property of Political Parties.

Any House property related to Charitable trust & Religious body.

Deductions are available under section 24, detail given below:-

Standard deduction is 30% of NAV, no other expenses are allowed under this head related to repair of building.

Deduction of interest paid during the financial year is deductible from NAV.

Total deduction for self occupied house capped at Rs. 2 lakh.

Gross annual value is higher of Expected rent and actual rent of property.

Exemption:-

In case of property is Vacant in FY for some period, then deduction is allowed to calculate the GAV.

Please login to your member account to post reviews.